Stamp Duty Video Description

What is stamp duty?

- Whether you're buying or selling property, you need to pay stamp duty.

-

Stamp duty is a tax on various documents, including legal, business, and financial papers.

- All transactions, like selling, transferring, mortgaging, and loan documents, must have this stamp duty for legal approval.

There are two types of stamp duty:

Ad valorem: "Ad valorem" means "according to value." This stamp duty is based on the value of legal documents, depending on the terms and conditions specified or the market value of the property.

Fixed duty: It stays the same, no matter what the terms and conditions of the transaction documents are or the market value of the property.

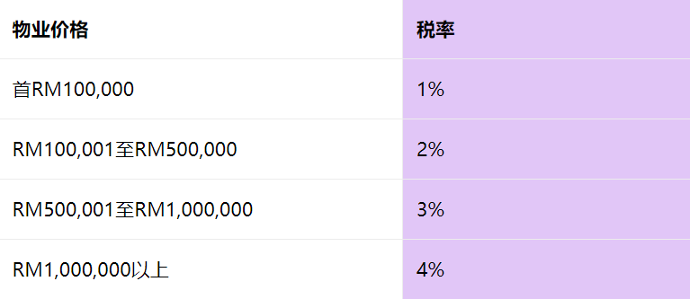

How to calculate stamp duty?

Even though the government exempts first-time homebuyers from stamp duty, you might buy a house for investment or transfer property in the future. So, it's essential to understand how stamp duty is calculated for different property prices.

First-Time Homebuyer Stamp Duty

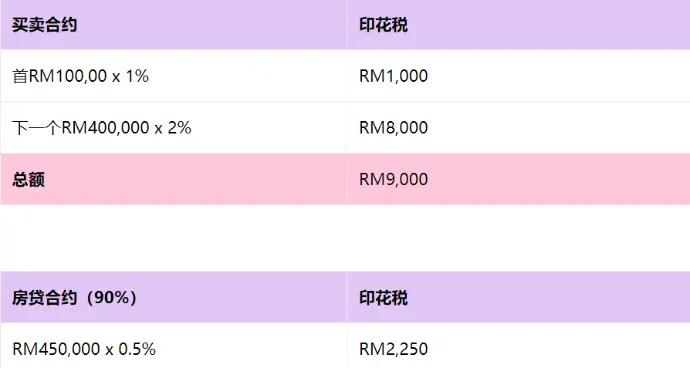

In the government's 2021 budget announcement, they said that if first-time homebuyers purchase a house below the value of RM500,000, they can be exempted from stamp duty, saving them RM11,250. Now, how did they get RM11,250? Let's take a RM500,000 house as an example:

What is stamp duty ?