Introduction: Why Audit Exemptions Matter

The new audit exemption criteria aim to ease the financial burden on micro and small private companies while ensuring financial accountability. Implemented in phases from 2025 to 2027, these changes provide clearer thresholds for companies to qualify for audit exemption.

Current Audit Exemption Criteria

Private companies can currently qualify for audit exemption under these categories:

- Dormant Companies

- Companies that have been dormant since incorporation.

- Companies dormant during the current and immediate past financial year.

- Zero-Revenue Companies

- Revenue = RM0 for the current and immediate past two financial years.

- Total Assets ≤ RM300,000.

- Threshold-Qualified Companies

- Revenue ≤ RM100,000.

- Total Assets ≤ RM300,000.

- No more than 5 employees.

New Audit Exemption Criteria (Effective 2025)

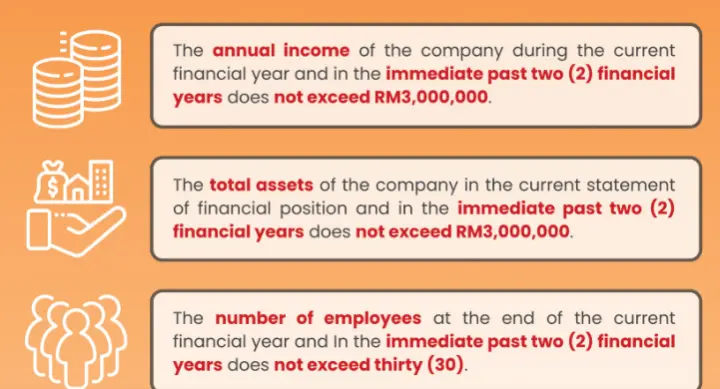

To qualify for audit exemption under the new criteria, companies must meet at least two out of the following three conditions:

- Annual Revenue

- Revenue ≤ RM3,000,000 over the current and immediate past two financial years.

- Total Assets

- Total assets ≤ RM3,000,000 in the current and past two financial years.

- Number of Employees

- No more than 30 employees at the end of the current and past two financial years.

Phase-by-Phase Implementation Timeline

2025 (Phase 1):

- Thresholds:

- Turnover: RM1,000,000.

- Assets: RM1,000,000.

- Employees: 10.

- Financial Period: 1 January 2025 – 31 December 2025.

- Submission Year: From 1 January 2026.

2026 (Phase 2):

- Thresholds:

- Turnover: RM2,000,000.

- Assets: RM2,000,000.

- Employees: 20.

- Financial Period: 1 January 2026 – 31 December 2026.

- Submission Year: From 1 January 2027.

2027 (Phase 3):

- Thresholds:

- Turnover: RM3,000,000.

- Assets: RM3,000,000.

- Employees: 30.

- Financial Period: From 1 January 2027 onward.

- Submission Year: From 1 January 2028.

Other Conditions and Limitations

- Still Exempt:

- Companies dormant since incorporation.

- Companies dormant during the current and immediate past financial year.

- Not Eligible:

- Exempt private companies opting for special status under Section 260 of the Companies Act 2016.

- Public companies or subsidiaries of public companies.

- Foreign companies.

If a company no longer qualifies for exemption, it must comply with audit requirements starting from the financial year it becomes disqualified.

New Audit Exemption Criteria for Malaysian Companies: What You Need to Know