印花盖章服务视频解析

印花税是什么?

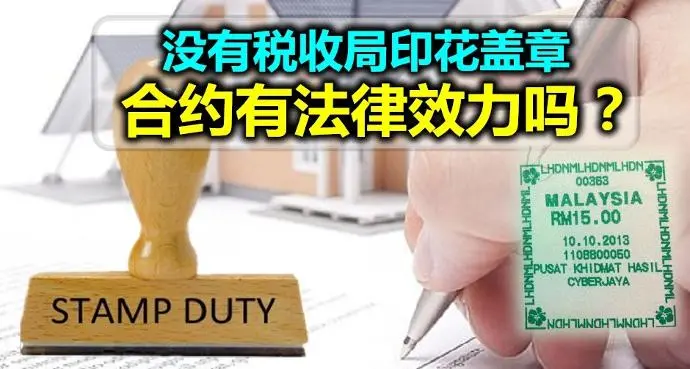

印花税是一种特殊的税,用于对法律、商业及财务相关文件进行征税。当我们进行重要交易,如买卖、转让或借款时,需要在文件上加盖一个特殊印章,这就是印花税。 .

为什么租赁协议需要印花税?

1: 租赁协议是一份具有法律效力的文件 它明确列出房东与租客在租赁前达成的所有约定。

2: 保护双方利益 在马来西亚,目前对住宅租赁尚无严格法规,因此租赁协议对于保护房东和租客的权益至关重要。

3: 明确费用责任 协议中清楚列明租客需支付的费用,如水电费、垃圾处理费等。 同时,房东也能通过协议避免对这些费用承担法律责任。

4: 法律认可 租赁协议必须经过 马来西亚内陆税收局(LHDN) 的盖章,才能在法庭上被承认为有效文件。 支付印花税是签署租赁协议的最后一步。

5: 文件副本需盖章

通常租赁协议有两份,一份给房东,一份给租客。两份文件都需要加盖印花章才具有法律效力。

租赁协议的印花税费率

1: 一年租期: 年租金超过 RM2,400:每 RM250 收取 RM1 的印花税。 年租金低于 RM2,400:免征印花税。

2: 1至3年租期: 年租金超过 RM2,400:每 RM250 收取 RM2 的印花税。 年租金低于 RM2,400:免征印花税。

3: 超过三年租期: 年租金超过 RM2,400:每 RM250 收取 RM4 的印花税。 年租金低于 RM2,400:免征印花税。

4:

文件副本盖章费用:

每份租赁协议副本的盖章费用为 RM10(一份给房东,一份给租客)。

为什么租赁协议需要印花税?